SubSaharan Africa in trouble: The invisible burden: How arrears could unleash a banking crisis

(000008.301:E-007663.1:N-:R-GS:C-30:V)

Erica Bosio, Rita Ramalho, Carmen Reinhart 22 March 2021

In sub-Saharan Africa, the government is one of the biggest purchasers of works and services in the economy. Countries in sub-Saharan Africa are also the least efficient when it comes to paying outstanding invoices. This column estimates that the size of government arrears in sub-Saharan Africa was 4.26% of GDP in 2019, and likely increased by an average of 1.92 percentage points of GDP across the region in 2020. Financing the COVID relief and recovery programmes by delaying payments is negatively affecting suppliers and contractors at a time when liquidity is crucial for firm survival, which in turn burdens the banking sector and increases the likelihood of a banking crisis.

Governments worldwide are working to provide crucial support to the private sector during the current crisis, in the form of tax breaks and financial aid (Baldwin et al. 2020). Many are resorting to suspending or delaying the payment for goods, services, and works procured from the private sector. This is a short-term tactic to free up resources to fund the relief and stimulus programmes. It may, however, end up worsening the situation by triggering a banking crisis.

The impact of arrears on the financial viability of the private sector is not trivial (De Paoli et al. 2009, Diamond and Schiller 1987, Erce 2015). In sub-Saharan Africa, where public procurement expenditure averages 12% of GDP, the government is one of the biggest purchasers of works and services in the economy. The size of procurement expenditure ranges from around 1.1% of GDP in the Central African Republic to 30% of GDP in Nigeria. Countries in sub-Saharan Africa are also the least efficient when it comes to paying outstanding invoices. The average payment time for completed works is 148 days.

The arrears problem in sub-Saharan Africa is not new. According to the IMF (2019a), arrears in the region amounted to 4–6% of GDP in the period 2005-2018. Based on payment delays data from Bosio et al. (2020a) and public procurement expenditure data, the size of government arrears in sub-Saharan Africa is estimated as 4.26% of GDP in 2019. To calculate this number, we took sub-Saharan Africa countries where the average payment time exceeds 45 days and used the ratio of the number of days required to process payment beyond 45 days over the number of days in a year multiplied by the total public procurement as a percentage of GDP. The 45-day limit was chosen as a conservative threshold compared with the common practice of limiting payment times to 30 days. This is the first wide coverage dataset estimating domestic arrears to the private sector. This type of arrears is often ignored and under measured.

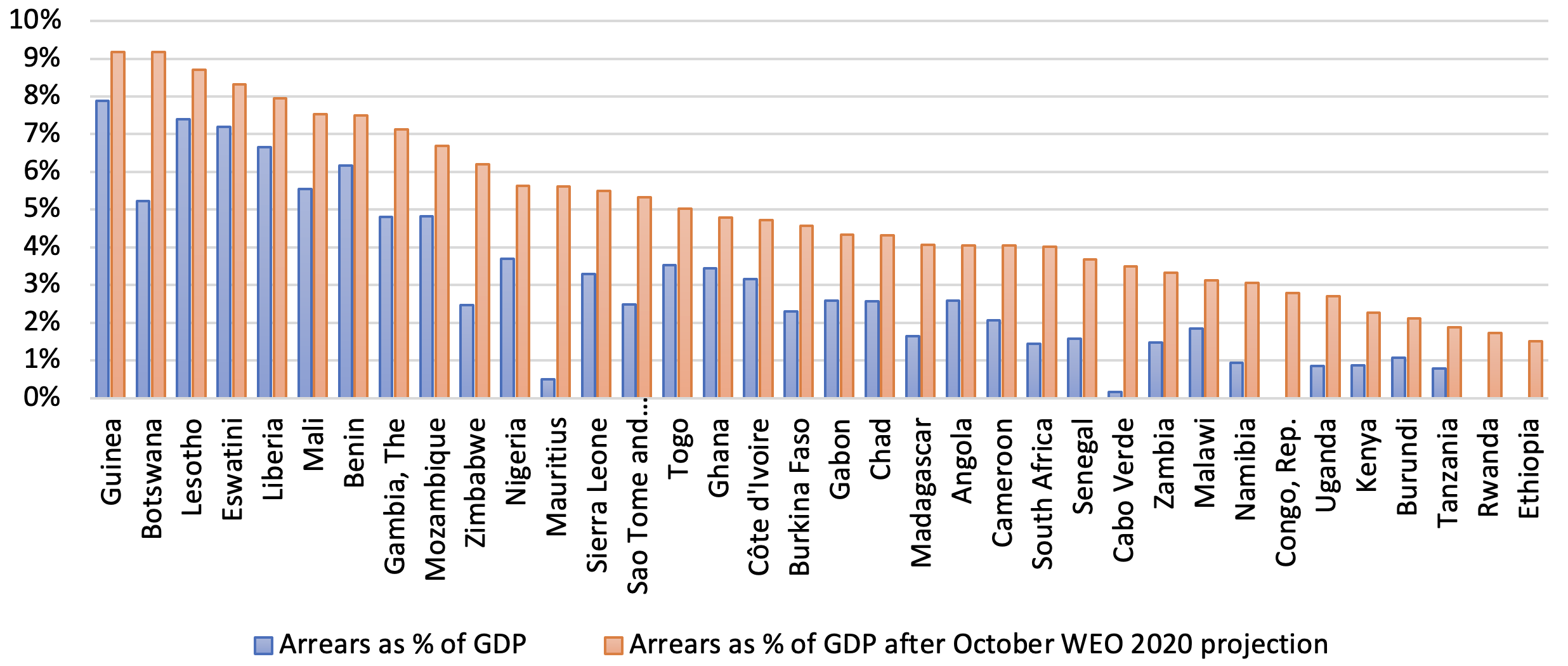

In 2020, as countries’ economies shrink, arrears were only destined to grow. Using the IMF estimated elasticity of –0.284 (IMF 2019a) and the latest IMF GDP forecast projection, we expect that arrears increased by an average of 1.92 percentage points of GDP across sub-Saharan Africa. This estimate is in line with the results from Mastruzzi et al. (2021). Figure 1 presents the total government arrears that each country in sub-Saharan Africa have accumulated by the end of 2020, compared to 2019. While not new, domestic arrears to the private sector problem are being exacerbated by the COVID crisis, potentially creating a spike in arrears.

Figure 1 Sub-Saharan Africa arrears as a percentage of GDP, 2019 and 2020

Sources: Bosio (2020a); IMF (2019b, 2020); World Development Indicators, GDP (current US$) database

The accrual of arrears is a costly strategy. Financing the relief and recovery programmes by delaying payments is negatively affecting the suppliers and contractors during a time when liquidity is crucial for firm survival (Bosio et al. 2020b). These firms are, in turn, more likely to draw credit (bad lines of credit in many cases), burdening the banking sector, already vulnerable (Demirguc-Kunt et al. 2020). The heightened risk of pervasive bankruptcies and defaults increases the likelihood of a banking crisis, caused by the over-exposure of banks to non-performing loans. As governments try to walk this tightrope, they need to be wary of the unexpected outcomes of their decisions and pay attention to expenditure arrears (Seeds and Flynn 2020). Furthermore, arrears can have negative impacts not only in the balance sheet of firms, but ultimately in the balance sheet of households. Drawing on lessons old and new (Dobler et al. 2020) is recommended, to prevent the worst outcomes.

References

Baldwin, R and B W di Mauro (eds.) (2020), Mitigating the COVID Economic Crisis: Act Fast and do Whatever It Takes, CEPR Press.

Bosio, E, S Djankov, E Glaeser, A Shleifer (2020a), “Public Procurement in Law and Practice”, NBER Working Paper no. 27188.

Bosio, E, J Lemoine, F Jolevski, R Ramalho (2020b), “Survival of Firms in Developing Economies During Economic Crisis”, Financial Markets Group Special Papers SP 255.

Demirguc-Kunt, A, A Pedraza, C Ruiz-Ortega (2020), “Banking Sector Performance During the COVID-19 Crisis”, Policy Research Working Paper No. 9363.

De Paoli, B, G Hoggarth, V Saporta (2009), “Output Costs of Sovereign Crises: Some Empirical Estimates”, Bank of England Working Paper No. 362.

Diamond, J, C Schiller (1987), “Government Arrears in Fiscal Adjustment Program”, FinanzArchiv/Public Finance Analysis 45, No.2: 229-259.

Dobler, M, M Moretti, A Piris (2020), “Managing Systemic Banking Crises: New Lessons and Lessons Relearned”, International Monetary Fund.

Erce, A (2015), “Banking on Seniority: The IMF and the Sovereign’s Creditors”, Governance 28(2): 219-263.

IMF (2019a), Regional Economic Outlook. Sub-Saharan Africa: Navigating Uncertainty. Background Paper: Online Annexes and Statistical Data.

IMF (October 2019b), World Economic Outlook, October 2019: Global Manufacturing Downturn, Rising Trade Barriers.

IMF (October 2020), World Economic Outlook, October 2020: A Long and Difficult Ascent.

Mastruzzi, M, E Tawfik, R Utz, F Vasquez (2021), “An Overview of the Potential Impact of the COVID-19 Crisis on the Accumulation of Government Expenditure Arrears”, World Bank Working Paper No. 155813.

Seeds, P and S Flynn (2020), “Expenditure Arrears and the Covid-19 Pandemic”, PMF Blog, 11 June.

Source: https://voxeu.org/article/how-arrears-could-unleash-banking-crisis

Cartoon: From a Boer: White Liberal and the Black Jewish President Ramaphosa in LOVE

This guy does good cartoons. In this one he mocks the Jewish political party the DA and it teaming up with the ANC after the recent elections. Jan

Video: Jews Rape Children Jews rape kids and more kids and more kids

Jews, especially Rabbis rape a lot of kids... you‘ll see in this short video.

Black lies from 2006: Zimbabwe: Only 200 White Farmers paid of 4,000 Rest paid in 2010? Oh Yeah?

I posted this in 2006. The Blacks had stolen 4,000 farms out of the 5,000 that were there. They lied about paying the White Farmers. You can read my skepticism and the news from 2006.