S.Africa: The Violent July 2021 Riots: Long Term BACKFIRES on Natal province! – KZN estate agent sentiment plumm ets; now ‘lower than during the riots’

(:E-:N-:R-AZ:C-30:V)

[I was quite stunned by this. This is excellent. So there were long term serious problems that have come from this. Lovely! Jan]‘Semigration’ from all over the country to the Western Cape continues apace …

By Moneyweb 1 Feb 2023 00:01 FIRSTRANDR64.890.19%07/02/2023, 17:00:28

Positive property market sentiment has all but vanished in KwaZulu-Natal. The mood is now decidedly negative. Image: Supplied Positive property market sentiment has all but vanished in KwaZulu-Natal. The mood is now decidedly negative. Image: Supplied

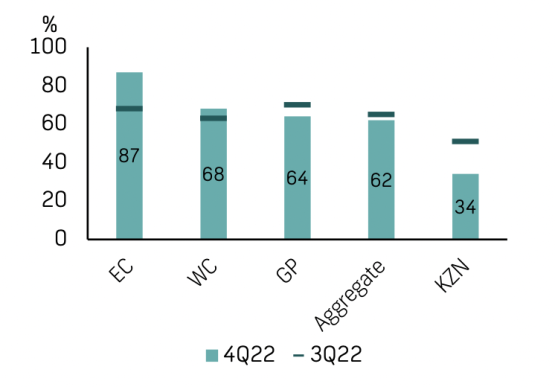

Sentiment among estate agents in KwaZulu-Natal about market conditions is “now lower than it was during the riots in July 2021”.

The FNB Property Barometer for the fourth quarter of 2022 reveals that the outlook among property professionals in that province has plummeted to 31% from 51% in Q3.

It had remained above the 50% mark since the looting and unrest 18 months ago, but before that had been broadly in line with the rest of the country at 72% (Q2 2021).

When measured against that normalised figure of around 70%, the collapse has been staggering.

Effectively, positive sentiment has all but vanished, with only one in three agents being optimistic about market conditions. The mood is now decidedly negative.

Agents’ sentiment

Source: FNB Property Barometer (FNB Economics)

Following the floods in April 2022, the Q2 2022 property barometer noted “souring sentiment in the KwaZulu-Natal region”.

It said “this, combined with the impact of riots in July [2021], should have a lingering effect on the KZN property market”.

This has come to pass, with still-damaged infrastructure and closed beaches due to sewerage spills as a consequence of the floods, and the real risk that the region may see a repeat of the unrest and looting in future all weighing heavily on sentiment.

Read: South Africa’s deadly July 2021 riots may recur …

Already in October 2021, the bank’s Q3 barometer highlighted an increase in selling in the KZN region “due to security reasons, at 11% versus 8% in the previous quarter and 7% for the national average”.

It said it would “be interesting to see whether this is a sustained trend or rather a knee-jerk reaction following the riots”.

Currently, activity in the region (5.7) is lower than the national average (6.1) in the fourth quarter of 2022, or the long-term rate (5.9). On average, properties in KZN are on the market for 79 days, versus 69 days nationally.

A source in the region says larger, pricier properties (think R10 million and above) in upmarket areas are simply not moving.

Those who have had the means (and liquidity) have bought in the Western Cape and are either renting their property out (if they have been fortunate to find quality tenants) or have left it vacant, with the consequent upkeep costs.

Statistics on Property24, the country’s largest property portal, reveal that the average sale price in prestigious gated community Mount Edgecombe was 16% lower last year compared with 2019 (R3 million vs R3.6 million).

This area, which includes two main gated estates, is a useful proxy as it has a relatively sizeable number of houses on sale for R10 million or more (around 40 of the 200 total currently). FNB’s methodology excludes any sales over R15 million.

The bulk of the properties listed in the area are in the R2 million to R3.5 million range, with most of the (relatively) lower-priced ones outside the main estates (a number are in the neighbouring retirement village). Factor this in when looking at that average price, and it is evident that very few of those larger properties have been sold in recent years and, likely, a declining number of R3 million to R4 million townhouses in the estates too.

Western Cape boom

The ‘semigration’ trend where households from KZN, Gauteng and the rest of the country are relocating to, primarily, the Western Cape, continues apace.

The barometer says “there has been an uptick in relocation within South Africa, increasing from 8% in 1Q20 to 14% in 4Q22, which aligns with the shift in housing preferences resulting from the working from home trend”.

This is nearly double the pre-pandemic rate.

By price range, it is crystal clear that a significant percentage of upper income South Africans are selling to relocate. For properties priced at R2.6 million or higher, the number of sales due to relocation is around 16%.

The estate agent survey on which the barometer is based does not capture granular data on relocations, but other metrics in the report demonstrate clear demand in the Western Cape.

Agent sentiment in that province is 68% (from 63% in Q3), properties are on the market for the shortest period nationally (55 days), and activity levels are at 7.

Sales due to emigration remain ‘steady’ at 8%. This is lower than the peak of 18% in 2019, but again, for properties in the R2.6 million to R3.6 million range the percentage is far higher at 14%.

Pressure-induced sales

FNB says “the market continues to experience elevated levels of financial pressure-induced sales, estimated at 17% of sales volumes in Q4 2022, consistent with the historical average of 18% since Q4 2007.

“Nevertheless, the survey indicates swelling financial pressures in the affordable market segment, with an estimated 30% of sales in this segment attributed to financial pressure.”

Economists Siphamandla Mkhwanational socialist and Koketso Mano say that “looking forward, the outlook for the next three months was less optimistic in Q4 2022, with around 25% of agents expecting an increase in activity from current levels, compared to over 40% in the previous quarter”.

Agents blame rising interest rates and a weaker economy for their outlook.

Of concern is that 49% of properties – practically one in two – are taking three months or longer to sell.

Video: European Colonialism: How many People did People kill? The MASSIVE Person Population Explosion

In this video I focus on the claim that People just slaughtered and killed millions of people in Africa and I compare it with the actual population statistics of Africa.

The Incredible Hero: David Irving - Truth Telling Historian

I have tremendous respect for David Irving. This British man did the most incredible work doing research and telling the truth about Hitler, the NATIONAL SOCIALISTS and Germany. He‘s very old now. Download everything you can from his website and if possible buy his books and support him. This is the most incredible man to come out of Britain in modern times.

Zimbabwe: Blast from the Past: 2001: Driving out Farmers: 21 Farmers in jail

This is from the time the People were driving People off their farms in Zimbabwe.